Thought Leaders on Bridging the Global Wealth Gap

Learn about the global wealth gap, challenges to bridging it, innovative solutions, role of technology, and empowering communities through financial education. Get informed now!The global wealth gap has been a topic of concern for decades, with disparities in income and access to resources contributing to inequality on a global scale. In this blog post, we will delve into the complexities of the global wealth gap and its implications for communities around the world. From understanding the root causes of this disparity to exploring the challenges and barriers that hinder efforts to bridge the gap, we will examine the multifaceted nature of this issue. Additionally, we will explore innovative solutions and approaches that have the potential to address these challenges, as well as the role of technology in facilitating wealth redistribution. Finally, we will discuss the significance of empowering communities through financial education, and how this can play a key role in leveling the economic playing field. Join us on this journey as we explore the insights of thought leaders on bridging the global wealth gap.

Understanding the Global Wealth Gap

The global wealth gap is a complex and multifaceted issue that has far-reaching implications for economies and societies. At its core, the wealth gap refers to the unequal distribution of assets, resources, and opportunities among individuals and communities around the world. This imbalance is often the result of various socio-economic factors such as income inequality, access to education, and disparities in employment opportunities. The consequences of the wealth gap can be dire, leading to increased poverty, social unrest, and diminished economic growth.

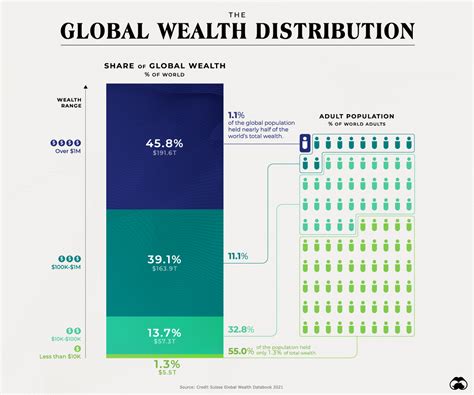

One of the key drivers of the global wealth gap is the unequal distribution of income. In many parts of the world, a small percentage of the population controls a disproportionately large share of the wealth, while the majority struggle to make ends meet. This extreme concentration of wealth can perpetuate cycles of poverty and socioeconomic inequality, creating barriers to upward mobility and economic prosperity for millions of people.

Addressing the global wealth gap requires a comprehensive and collaborative approach that tackles the root causes of inequality. This includes implementing policies that promote equitable access to education, healthcare, and employment opportunities. Additionally, innovative solutions such as wealth redistribution mechanisms and financial literacy programs can play a crucial role in bridging the wealth gap and empowering marginalized communities.

Challenges and Barriers to Bridging

One of the main challenges in bridging the global wealth gap is the lack of access to resources and opportunities for marginalized communities. Many people in developing countries face barriers such as limited education, healthcare, and infrastructure, which contribute to their inability to build wealth and improve their financial situation. Additionally, systemic issues such as corruption, political instability, and discrimination further exacerbate the wealth gap, making it difficult for individuals and communities to overcome these obstacles.

Another barrier to bridging the global wealth gap is the unequal distribution of wealth and resources. The concentration of wealth in the hands of a few individuals and corporations hinders the economic growth and development of less affluent regions. This imbalance not only perpetuates income inequality but also limits the potential for sustainable progress and prosperity for all members of society.

Furthermore, the lack of financial literacy and access to banking and credit services poses a significant challenge in addressing the global wealth gap. Many individuals, particularly in rural and underserved areas, do not have the knowledge or means to effectively manage their finances, invest in their future, or participate in the formal economy. This lack of financial inclusivity further widens the gap between the rich and the poor, preventing the equitable distribution of wealth and opportunities.

Innovative Solutions and Approaches

One of the innovative ways to bridge the global wealth gap is through microfinance initiatives. These programs provide small loans and financial services to individuals who are typically excluded from traditional banking systems. By empowering individuals to start their own small businesses, microfinance initiatives can create a ripple effect, helping to lift entire communities out of poverty.

Another approach to addressing the wealth gap is through impact investing. This involves investing in companies and organizations that are committed to making a positive social and environmental impact, in addition to financial returns. By directing capital towards companies that are focused on uplifting marginalized communities, impact investing can play a crucial role in redistributing wealth more equitably.

One solution that has gained traction in recent years is the concept of universal basic income (UBI). This idea proposes that all citizens receive a regular, unconditional sum of money from the government, regardless of their employment status. Proponents argue that UBI can help alleviate poverty, reduce inequality, and provide individuals with the financial security they need to pursue educational and entrepreneurial opportunities.

Role of Technology in Wealth Redistribution

Role of Technology in Wealth Redistribution

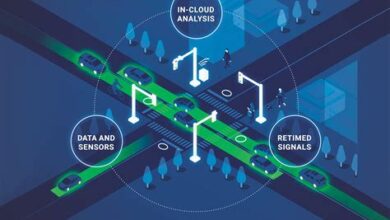

Technology has played a significant role in reshaping the global economy and has opened up new opportunities for wealth redistribution. With the rise of digital platforms and fintech solutions, individuals and communities have gained access to financial resources and services that were previously out of reach. The use of mobile banking, peer-to-peer lending, and digital currencies has empowered individuals to take control of their finances and participate in the global economy.

Furthermore, technology has enabled new models of wealth distribution, such as crowdfunding and impact investing, which allow individuals to invest in projects and businesses that align with their values and contribute to positive social change. Through the use of blockchain technology, transparent and secure transactions are possible, reducing the barriers to wealth redistribution and fostering financial inclusion for marginalized communities.

Additionally, advancements in artificial intelligence and big data analytics have provided opportunities for more accurate and inclusive financial assessment and risk management, leading to the development of innovative financial products and services that cater to a wider spectrum of the population. This has the potential to bridge the wealth gap by providing equal opportunities for wealth accumulation and financial growth, regardless of socioeconomic status or geographical location.

Empowering Communities through Financial Education

Financial education is a crucial component of empowering communities to achieve financial stability and independence. By providing individuals with the knowledge and skills necessary to make informed financial decisions, we can help them break free from the cycle of poverty and create a brighter future for themselves and their families.

One of the biggest barriers to financial education is the lack of access to resources and support. Many communities, especially in developing countries, do not have access to quality financial education programs or resources. This leaves individuals vulnerable to predatory financial practices and prevents them from achieving economic independence.

It is essential for governments, non-profit organizations, and private sector companies to work together to develop and implement effective financial education programs that are accessible to all members of society. By investing in financial education, we can empower communities to take control of their financial futures and build a more equitable and prosperous world for everyone.