Recent Changes in Taxation Policies: A Comparative Analysis

Explore the latest taxation policies and their impact on individual and corporate taxpayers. Includes analysis of recent changes and comparison with international tax policies.Taxes are an inevitable part of modern life, and staying abreast of changes in taxation policies is crucial for individuals and businesses alike. In this blog post, we will delve into the recent developments in taxation policies, analyze their impact on individual taxpayers and corporate entities, and compare them with international taxation policies. Understanding taxation policies is essential for making informed financial decisions, whether it’s for personal or business purposes. By examining the changes in tax laws and regulations, we can better comprehend how they affect our bottom line and plan accordingly. So, join us as we navigate through the complex world of taxation and gain a comparative perspective on the recent changes in taxation policies.

Introduction to Taxation Policies

When it comes to understanding a country’s economic structure, taxation policies play a crucial role. These policies are the rules and regulations set by the government to collect taxes from the citizens and businesses. Taxation policies are designed to ensure that the government has enough revenue to fund public services and infrastructure. They also aim to regulate the distribution of income and wealth within a country.

It is important to note that taxation policies can vary significantly from one country to another. Each government sets its own tax rates, laws, and exemptions based on its economic and social goals. Some countries may prioritize higher tax rates on the wealthy to reduce income inequality, while others may focus on attracting foreign investments through lower corporate tax rates. Understanding the different tax policies across the globe is essential for businesses and individuals operating internationally.

Moreover, taxation policies can also change over time due to various internal and external factors. Governments may introduce new policies or amend existing ones to adapt to changing economic conditions, social needs, or international pressures. Keeping up with the recent changes in taxation policies is crucial for taxpayers and businesses to comply with the law and minimize financial risks.

Analysis of Recent Policy Changes

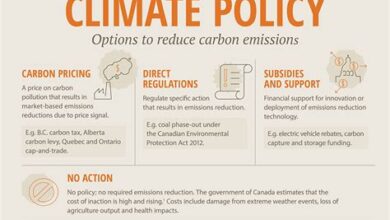

Recent changes in taxation policies have brought about significant impact on both individual taxpayers and corporate entities. The government’s decision to amend several tax laws and regulations has sparked debates and discussions among experts in the field. It is important to conduct a comparative analysis of these policy changes in order to understand the implications on various sectors of the economy.

One of the key areas of focus in analyzing recent policy changes is the impact on individual taxpayers. With the implementation of new tax brackets and deductions, many individuals have been affected in terms of their tax liabilities. Some taxpayers may benefit from these changes while others may face higher tax burdens. It is essential to examine the specific provisions of the new policies and their effects on different income groups.

Moreover, the recent policy changes also warrant a comparison with international tax policies. How do these amendments align with global standards and practices? Are there any potential discrepancies or inconsistencies that may impact international trade and investments? A thorough analysis of the international implications of the new taxation policies is crucial in understanding the country’s position in the global economy.

Impact on Individual Taxpayers

Recent changes in taxation policies have had a significant impact on individual taxpayers across the country. With the implementation of new policies, the tax burden on individuals has shifted, leading to both positive and negative consequences. Individuals are now facing new regulations and guidelines that may affect their financial situation and overall well-being.

One of the key impacts on individual taxpayers is the change in tax brackets and rates. With recent policy changes, many individuals have seen an increase in their tax liability, while others have experienced a decrease. This has led to a substantial financial impact on individuals, affecting their ability to save and invest for the future.

Furthermore, the introduction of new deductions and credits has also played a significant role in the impact on individual taxpayers. While some individuals may benefit from these new incentives, others may find themselves ineligible or facing reduced benefits. The complexity of these changes has made it challenging for individuals to navigate their tax obligations and maximize their tax savings.

Effect on Corporate Taxation

Recent changes in taxation policies have had a significant effect on corporate taxation. With the new regulations and policies in place, corporations are now facing a different set of rules and regulations when it comes to their tax obligations. This has led to a need for corporations to reassess their financial strategies and tax planning in order to adapt to the new policies and ensure compliance.

One of the major effects of the recent policy changes on corporate taxation is the alteration in tax rates and deductions. In some cases, corporations may benefit from lower tax rates, while in others, they may see a reduction in available deductions. This means that corporations now need to evaluate their tax liabilities and consider restructuring their financial operations to minimize the impact of these changes.

Furthermore, the recent policy changes have also brought about an increased focus on international taxation and anti-avoidance measures. This has consequently affected the way multinational corporations operate and plan their tax strategies. With the implementation of measures to prevent profit shifting and erosion of the tax base, corporations are now under greater scrutiny and are required to be more transparent in their financial reporting for tax purposes.

Comparison with International Tax Policies

Comparison with International Tax Policies

When it comes to taxation policies, it’s important to not only consider the domestic implications, but also how they compare to international standards. Many countries have their own unique tax policies that may differ from those in other nations. In the current global economy, it’s crucial for countries to understand how their taxation systems stack up against those of other nations in order to remain competitive.

One key aspect to consider when comparing international tax policies is the corporate tax rate. Different countries have varying corporate tax rates, with some imposing higher taxes on businesses than others. This can impact a company’s decision on where to base their headquarters or where to invest, as lower tax rates can be an attractive incentive for businesses. Understanding how a country’s corporate tax rate compares to that of other nations can offer valuable insights into its overall competitiveness in the global market.

Another important factor in comparing international tax policies is the treatment of foreign income. Countries may have different rules regarding how foreign income is taxed, with some employing a worldwide taxation system and others utilizing a territorial taxation system. The impact of these policies on individual taxpayers and multinational corporations can be significant, making it essential to analyze and understand how they differ across nations.