The Impact of Digital Currencies on the Global Economy

Explore the economic benefits, global trends, and regulatory challenges of digital currencies in this comprehensive introduction to their adoption and growth in the market.In the era of rapid technological advancement, digital currencies have emerged as a disruptive force in the global economy. With the rise of cryptocurrencies such as Bitcoin and Ethereum, the world is witnessing a paradigm shift in the way we perceive and use money. This blog post will explore the impact of digital currencies on the global economy, delving into various aspects such as adoption rates, economic advantages, market trends, and regulatory challenges.

The introduction will provide a comprehensive overview of what digital currencies are and how they have gained traction in recent years. It will also discuss the factors driving the adoption of digital currencies and the potential economic benefits they offer. Additionally, the blog post will examine the current global market trends in digital currencies and the regulatory challenges that governments and financial institutions are facing in response to this disruptive technology. Keep reading to gain a deeper understanding of the impact of digital currencies on the global economy.

Introduction to Digital Currencies

Before delving into the intricacies of digital currencies, it’s important to understand the concept of traditional currency. For centuries, physical cash has been the primary medium of exchange, facilitating transactions and economic activities. However, with the advent of digital technology, the landscape of currency is undergoing a significant transformation. Digital currencies, also known as cryptocurrencies, are virtual or digital forms of money that utilize cryptography for secure and decentralized transactions. Unlike traditional currencies, digital currencies operate independently of central banks and are typically managed through a distributed ledger technology known as blockchain.

The emergence of digital currencies has ushered in a new era of financial innovation and disruption. With the creation of Bitcoin in 2009, digital currencies have gained increasing attention and popularity as alternative forms of payment and investment. The decentralized nature of digital currencies has led to widespread adoption and usage across various industries, including e-commerce, remittances, and financial services.

Furthermore, the concept of digital currencies has sparked conversations about the future of money and the potential benefits and challenges that come with their widespread adoption. As we continue to explore the impact of digital currencies on the global economy, it’s essential to understand their underlying technology, market dynamics, and regulatory considerations.

Adoption of Digital Currencies

Adoption of Digital Currencies

The adoption of digital currencies has been steadily increasing in recent years, as more and more people and businesses are recognizing the potential benefits of using these types of currencies. One of the main reasons for the growing adoption of digital currencies is the increasing awareness and understanding of the technology behind them. As people become more familiar with blockchain technology and its potential applications, they are more likely to embrace digital currencies as a viable alternative to traditional forms of currency.

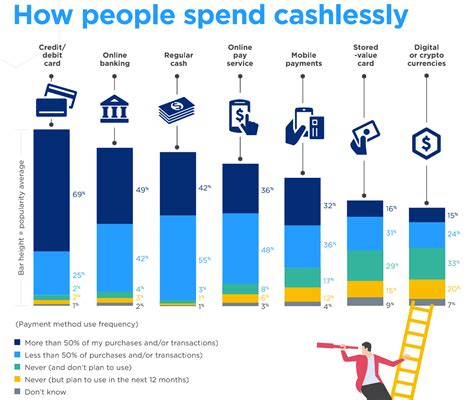

Another factor driving the adoption of digital currencies is the increasing convenience and accessibility of these currencies. With the rise of digital wallets and various payment platforms that support digital currencies, it has become easier than ever for people to use and transact with these currencies. As a result, more businesses are starting to accept digital currencies as a form of payment, further fueling their adoption.

Furthermore, the growing concern about financial privacy and the desire for more secure and decentralized forms of currency are also contributing to the adoption of digital currencies. With digital currencies, users have greater control over their financial transactions and can enjoy a higher level of privacy and security compared to traditional currencies. As a result, many people are turning to digital currencies as a way to protect their financial information and maintain greater control over their money.

Economic Advantages of Digital Currencies

One of the main advantages of digital currencies is their ability to facilitate instantaneous transactions across borders. This can significantly reduce the time and cost associated with traditional bank transfers and remittances, making it easier for individuals and businesses to engage in global trade and commerce.

Additionally, digital currencies can offer lower transaction fees compared to traditional financial institutions, especially for international transfers. This can result in substantial cost savings for businesses and consumers, and also enhance financial inclusion by providing a more affordable way to access banking services.

Furthermore, digital currencies have the potential to eliminate currency exchange and conversion fees, as they can be used as a universal medium of exchange without the need for intermediaries. This can streamline cross-border transactions and make it easier for individuals and businesses to engage in international trade without being limited by currency fluctuations and conversion costs.

Global Market Trends in Digital Currencies

The Impact of Digital Currencies on the Global Economy

Global Market Trends in Digital Currencies

As digital currencies continue to gain momentum around the world, it is important to take a closer look at the global market trends shaping their adoption and use. One of the most significant trends is the increasing acceptance of digital currencies by mainstream financial institutions. Major banks and investment firms are now offering products and services related to digital currencies, signaling a shift in the traditional financial landscape.

Another noteworthy trend is the growing interest in digital currencies from emerging markets. Countries with unstable economies and volatile currencies are turning to digital currencies as a potential solution to their financial challenges. This has led to increased use and adoption of digital currencies in regions such as Latin America, Africa, and Southeast Asia.

Furthermore, the rise of decentralized finance (DeFi) has created a new wave of market trends in digital currencies. DeFi platforms are enabling users to access financial services without the need for traditional intermediaries, such as banks. This trend is fueling the development of innovative applications and use cases for digital currencies, expanding their reach and impact on the global economy.

Regulatory Challenges for Digital Currencies

One of the major challenges facing the widespread adoption of digital currencies is the lack of clear and consistent regulations. Many governments and regulatory bodies around the world are still grappling with how to classify and regulate these new forms of currency. This uncertainty creates a barrier for businesses and consumers who are hesitant to fully embrace digital currencies without a clear legal framework in place.

Another regulatory challenge for digital currencies is the potential for increased scrutiny and oversight from financial authorities. As digital currencies become more mainstream, there is a concern that governments may seek to impose stricter regulations on their use, potentially stifling innovation and growth in the industry. This could also lead to increased compliance costs for businesses operating in the digital currency space.

Additionally, the international nature of digital currencies presents a unique challenge for regulators. With transactions occurring across borders and outside of traditional banking systems, it becomes difficult for any one jurisdiction to effectively regulate the industry. This lack of global coordination and cooperation further complicates the regulatory landscape for digital currencies.