Inflation and Its Effects on Consumer Purchasing Power

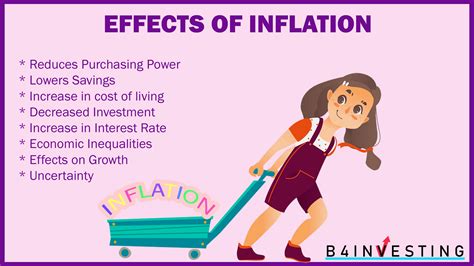

Learn about the causes and impact of inflation on consumer prices, real wages, and interest rates. Discover strategies to protect purchasing power.In today’s economic landscape, inflation is a significant factor that affects consumer purchasing power. Understanding the causes and effects of inflation is crucial for individuals and businesses to make informed financial decisions. In this blog post, we will delve into the topic of inflation and its impact on consumer purchasing power. We will explore the root causes of inflation, its influence on consumer prices, real wages, and interest rates. Additionally, we will provide strategies for protecting purchasing power in the face of rising inflation. By gaining a better understanding of these concepts, readers will be better equipped to navigate and mitigate the effects of inflation on their finances. Join us as we unravel the complexities of inflation and empower ourselves to make sound financial choices in the ever-changing economic landscape.

Understanding Inflation and Its Causes

The Impact of Inflation on Consumer Purchasing Power

Inflation is the rate at which the general level of prices for goods and services is rising and, subsequently, the purchasing power of currency is falling. It is important to understand the causes of inflation in order to grasp its impact on the economy and individual consumers. There are various factors that contribute to inflation, including the demand-pull effect, cost-push effect, and built-in inflation. Demand-pull inflation occurs when aggregate demand in the economy outpaces aggregate supply, leading to an increase in prices. On the other hand, cost-push inflation is caused by increases in production costs, such as labor or raw materials, which are then passed on to consumers in the form of higher prices. Additionally, built-in inflation refers to the tendency for workers to seek wage increases in anticipation of future price increases, thereby creating a self-perpetuating cycle of inflation. All of these factors play a role in driving inflation rates and impacting consumer purchasing power.

Aside from these immediate causes, there are also structural and monetary factors that contribute to inflation. Structural factors relate to long-term changes in the economy, such as demographic shifts, changes in technology, or government policies, which can affect the overall level of prices. On the other hand, monetary factors involve the actions of central banks and the money supply. By increasing the money supply, central banks can stimulate spending and investment, but if done excessively, it can lead to inflation. Understanding these underlying factors is crucial in developing strategies to mitigate the effects of inflation on consumer purchasing power.

Overall, a comprehensive understanding of inflation and its causes is essential for both policymakers and consumers. By identifying the various factors that contribute to inflation, individuals and businesses can make informed decisions to protect their purchasing power and navigate the economic landscape effectively. Whether through adjusting investment portfolios, negotiating wage contracts, or advocating for prudent monetary policies, recognizing the causes of inflation is the first step in addressing its impact on consumer prices. Stay tuned for future posts on the strategies for protecting purchasing power and other aspects of inflation’s influence on the economy.

Impact of Inflation on Consumer Prices

Inflation and Its Effects on Consumer Purchasing Power

Understanding the impact of inflation on consumer prices is essential for individuals and households to make informed financial decisions. Inflation causes the overall price level of goods and services in an economy to rise over time, leading to a decrease in the purchasing power of consumers. When consumer prices increase, each unit of currency buys fewer goods and services, ultimately reducing the standard of living for individuals and families.

One of the most significant factors contributing to the impact of inflation on consumer prices is the cost of production. As the prices of raw materials, labor, and other production inputs escalate due to inflation, businesses are forced to pass on these higher costs to consumers by raising the prices of their products and services. This leads to an increase in the overall consumer prices for essential items, such as groceries, clothing, and housing, making it more challenging for individuals to afford these necessities.

Furthermore, the impact of inflation on consumer prices can result in a phenomenon known as cost-push inflation. This occurs when the escalating prices of production inputs, such as energy or transportation, force businesses to raise prices, creating a cycle of further inflation. As consumer prices continue to climb, individuals and families may experience a decrease in their purchasing power, as their income may not keep pace with the rising costs of goods and services.

Inflation’s Influence on Real Wages

Inflation can have a significant impact on real wages, affecting the purchasing power of individuals and the overall standard of living. When the rate of inflation outpaces wage growth, it effectively reduces the amount of goods and services that can be purchased with a set level of income. As prices for everyday necessities such as food, housing, and healthcare rise, workers find themselves with less disposable income, making it more difficult to maintain their desired standard of living. This phenomenon can particularly affect lower-income individuals and those on fixed incomes, as their wages do not necessarily increase in line with inflation rates.

Furthermore, inflation can lead to a decrease in real wages, as nominal wage increases may not keep up with the pace of rising prices. This can lead to a situation where workers may feel like they are earning more money, but in reality, their purchasing power has actually decreased. As a result, individuals may need to work longer hours, take on additional jobs, or make sacrifices in their spending habits to offset the impact of inflation on their real wages.

Additionally, inflation’s influence on real wages can create economic challenges beyond the individual level. When real wages decline due to inflation, consumer spending may decrease, leading to reduced demand for goods and services. This can impact businesses and employment levels, potentially leading to economic downturns and increased inequality among different income groups. Therefore, understanding the effects of inflation on real wages is crucial for policymakers, employers, and employees alike in crafting effective strategies to mitigate its negative impacts.

Inflation and Interest Rates

Inflation and Interest Rates

When it comes to understanding economic concepts, one of the most crucial relationships to grasp is the connection between inflation and interest rates. Inflation refers to the increase in prices of goods and services over time, leading to a decrease in the purchasing power of money. Meanwhile, interest rates represent the cost of borrowing money or the return on investment. These two factors are closely intertwined and have a significant impact on the overall economy.

One of the primary effects of inflation on interest rates is its influence on the nominal interest rate. As inflation rises, lenders demand higher interest rates to compensate for the decrease in the value of the money they will be repaid in the future. This means that borrowers will face higher borrowing costs, making it more expensive to take out loans for homes, cars, or other major purchases. Additionally, inflation also affects the real interest rate, which is the nominal interest rate adjusted for inflation. A higher inflation rate leads to a lower real interest rate, reducing the incentive for people to save money and decreasing the overall amount of savings in the economy.

Furthermore, the relationship between inflation and interest rates also has important implications for the behavior of central banks. Central banks use monetary policy to control inflation and stabilize the economy. In response to high inflation, central banks may increase interest rates to reduce the amount of money flowing in the economy, thereby slowing down spending and lowering inflation. Conversely, in periods of low inflation or deflation, central banks may lower interest rates to stimulate borrowing and spending, boosting economic activity.

Strategies for Protecting Purchasing Power

Protecting your purchasing power involves developing a long-term financial plan that will shield your investments and income from the negative effects of inflation. One strategy is to invest in assets that have historically shown a strong correlation with inflation, such as real estate and commodities. These tangible assets tend to hold their value or even appreciate during times of high inflation, preserving your purchasing power.

Another approach is to consider investing in Treasury Inflation-Protected Securities (TIPS), which are specifically designed to protect against inflation. These government bonds adjust their principal value based on changes in the Consumer Price Index and provide a reliable source of income that keeps pace with inflation.

Additionally, it’s important to diversify your investment portfolio across different asset classes, such as stocks, bonds, and cash equivalents. This ensures that your overall portfolio can withstand the impact of inflation and market fluctuations, ultimately safeguarding your purchasing power over time.