Economic Forecast 2024: Predictions from Top Analysts

Gain insights into global economic trends, factors influencing forecasts, regional economic outlooks, industry-specific projections, and impacts on the stock market in this comprehensive blog post.As we approach the year 2024, the global economy is facing a myriad of opportunities and challenges. In this blog post, we will delve into the economic forecast for 2024, and explore the predictions from top analysts in the field. From global economic trends to industry-specific projections, we will examine the factors influencing the forecast and the potential impacts on the stock market. By analyzing regional economic outlooks, we aim to provide a comprehensive overview of what lies ahead for the world economy. As we navigate through various economic indicators and market forces, it becomes essential to gain insights into the potential trends and developments that may shape the economic landscape in the coming year. Whether you are a business owner, investor, or simply interested in staying informed about the state of the global economy, this blog post aims to provide valuable insights into the economic forecast for 2024.

Global Economic Trends

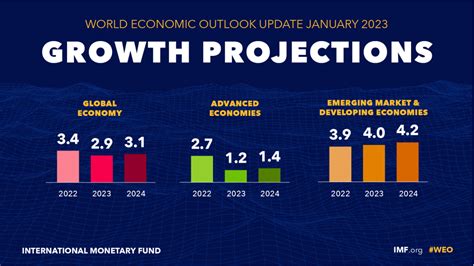

Global Economic Trends: In the ever-changing landscape of the global economy, it is important for investors, businesses, and policymakers to stay informed about the latest trends. One of the key factors influencing the global economic forecast for 2024 is the ongoing trade tensions between major economies, which could have a significant impact on global growth. Additionally, the rising trend of digitalization and technological advancements is expected to reshape the global economy, with implications for industries worldwide.

Another aspect to consider when looking at global economic trends is the regional economic outlooks. Different regions of the world are experiencing unique challenges and opportunities, which can greatly influence the overall global economic forecast. For example, emerging economies in Asia are projected to continue driving global growth, while geopolitical developments in regions such as the Middle East and Europe could create economic uncertainties.

These industry-specific projections are essential for businesses to anticipate changes in consumer demands, supply chain disruptions, and regulatory shifts. For instance, the renewable energy sector is expected to experience significant growth as countries worldwide aim to reduce carbon emissions. On the other hand, the automotive industry is facing challenges due to changing consumer preferences and technological advancements in electric and autonomous vehicles.

Factors Influencing Forecast

When it comes to predicting the economic forecast for 2024, there are several factors that can influence the outcome. One of the biggest factors to consider is the global economic trends. The state of the global economy has a significant impact on the economic forecast, as it can affect trade, investment, and overall market conditions.

Another important factor to consider is the regional economic outlooks. Different regions around the world can experience different economic conditions, and these regional differences can have a direct impact on the overall economic forecast. For example, a strong economy in one region can help offset a weaker economy in another region.

Industry-specific projections also play a key role in influencing the economic forecast. Certain industries may experience growth or decline based on various factors such as consumer demand, technological advancements, or government regulations. These industry-specific projections can have a ripple effect on the overall economy and should be taken into consideration when making economic forecasts.

Regional Economic Outlooks

When considering the Regional Economic Outlooks for 2024, it’s important to take into account the various factors that can influence the economic landscape of different regions. The state of the global economy, political stability, natural disasters, and technological advancements all play a role in shaping the economic forecast for different regions around the world.

Top analysts predict that regions with a strong focus on technology and innovation will experience significant growth in 2024. Countries in Asia, such as China and India, are expected to continue their upward economic trajectory, driven by advancements in technology and a growing consumer market. On the other hand, regions heavily reliant on traditional industries such as manufacturing and agriculture may face challenges in the coming year.

In addition, the ongoing trade tensions between major economies like the United States and China will continue to have a significant impact on regional economic outlooks. Many analysts believe that these tensions could lead to disruptions in global supply chains and trade patterns, which will in turn affect the economic prospects of various regions.

Industry-Specific Projections

When looking at the economic forecast for 2024, it’s important to consider the industry-specific projections that top analysts are making. Each industry is influenced by different factors, and as a result, their predictions for the future can vary significantly. For example, the technology sector may have different projections compared to the manufacturing or healthcare industries. Understanding these industry-specific projections can provide valuable insights for investors and businesses looking to make strategic decisions.

One of the key factors influencing industry-specific projections is the state of the global economy. Industries that are closely tied to international trade may be heavily impacted by global economic trends, such as tariffs, trade agreements, and currency fluctuations. Additionally, consumer behavior and purchasing power can also impact industry-specific projections. For example, the retail industry may face different challenges compared to the entertainment or hospitality sectors.

Another important consideration for industry-specific projections is the regional economic outlook. Different regions may experience varying levels of economic growth, political stability, and regulatory changes. For example, industries that are heavily regulated may see different projections in regions with stringent environmental or labor laws compared to those with more relaxed regulations. Understanding the regional economic outlooks can provide valuable context for industry-specific projections.

Impacts on Stock Market

The stock market is influenced by a wide range of factors, including global economic trends, industry-specific projections, and local and regional economic outlooks. These influences can have a significant impact on the performance of individual stocks, as well as the market as a whole.

For example, shifts in global economic trends such as changes in interest rates, inflation, or economic growth can cause fluctuations in the stock market. Similarly, industry-specific projections, such as changes in consumer demand or advances in technology, can lead to both positive and negative impacts on stock prices.

Furthermore, regional economic outlooks play a crucial role in determining the performance of the stock market. Factors such as regional political stability, infrastructure development, and changes in consumer spending habits can all influence the stock market in specific regions.