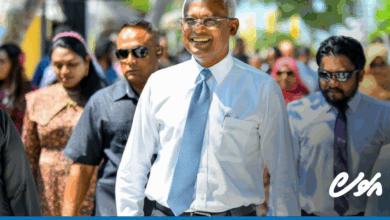

Pres Dr. Muizzu stands firm on dollar exchange policy, rules to remain unchanged

President Dr. Mohamed Muizzu has reaffirmed the government’s commitment to enforcing the Maldives Monetary Authority (MMA)’s new dollar exchange policies for tourism establishments,

MMA recently introduced a new policy where tourism establishments are mandated to deposit and convert a percentage of their US dollar revenue to local banks. This policy, set to take effect on January 1, 2025, has sparked opposition from some of the Maldives’ largest domestic investors, including the prominent Champa and Universal Groups.

Addressing these concerns at a ceremony held on the occasion of the government’s one-year anniversary on Sunday, President Dr. Muizzu defended the decision and said the government would not change the new policy despite opposition.

Acknowledging the contribution of Champa and Universal Group owners, who are among the pioneers of the Maldives’ tourism industry, President Dr. Muizzu thanked them for their contribution and service to the industry over the years. He urged them to support the policy and join the people’s side, and not allow politicians working against the government to take undue advantage of tourism businesses.

“Join the people’s side. Do not allow politicians who oppose progress to exploit your legacy. We are here for the people, and we invite you to join us for the greater good of the nation,” he said.

The President highlighted that the tourism industry generates $4.5 billion annually, yet only 1.5 percent of this amount currently reaches local banks. Under the new policy, 20 percent of tourism-related dollar revenue will be deposited in local banks.

The President said one of the most impactful changes that would come from exchanging dollars in accordance with the MMA rules would be the elimination of black-market dollar exchanges for state-owned enterprises (SOEs), which currently causes great financial strain on the government. This reform will allow SOEs to purchase dollars at official bank rates, he noted.

The president highlighted some expected benefits the dollar exchange policy would bring about, including increasing the current $500 issued to travelers at bank rate to $1000 and increasing credit card limits from $750 to $1400. If the rule is followed, the changes can be implemented in the first quarter of 2026, he said.

He added that the amount of dollars currently issued by banks to importers who pay by TT would also be increased within six months of the implementation of the dollar exchange rule.

“Why resist this when it stands to benefit the entire nation?” the President questioned, addressing critics of the policy.

The President reiterated that, while the rule aligns with the Constitution and laws, it will not be changed as it will benefit all the people. He said a forex law would be enacted to facilitate the MMA’s implementation of the rule.